This task can be performed using ValueEQ

#1 Business Valuation Software

Best product for this task

ValueEQ

fintech

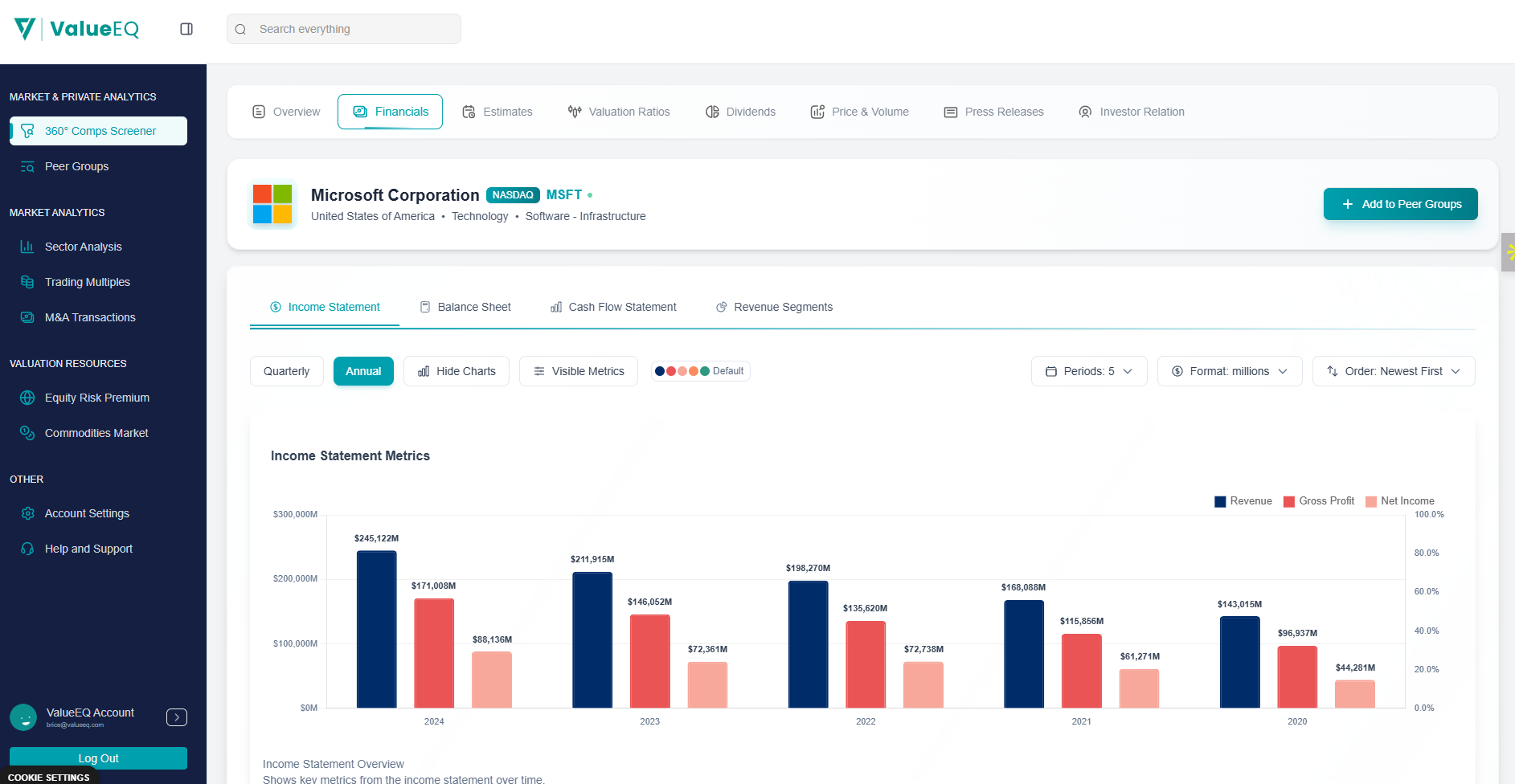

ValueEQ is the #1 Business valuation Software leveraging artificial intelligence that unifies global public comps, M&A deal data, and integrated WACC/DCF modeling so investment teams can mark portfolios, price rounds, and compare targets with confidence—without legacy terminal costs.

What to expect from an ideal product

- ValueEQ pulls together public company data and M&A deals from around the world in one place, so you don't have to hunt through multiple sources to find the right comparables for your valuation

- The AI technology automatically identifies companies that match your target business, saving hours of manual research that would normally take analysts days to complete

- You get both trading multiples from public companies and transaction multiples from actual M&A deals, giving you a complete picture for more accurate valuations

- The platform includes built-in DCF and WACC modeling tools, so you can run your comparable analysis and financial models in the same system without switching between different software

- Everything works without expensive Bloomberg or Capital IQ subscriptions, making professional-grade comp analysis accessible at a fraction of the cost of traditional data terminals