This task can be performed using ValueEQ

#1 Business Valuation Software

Best product for this task

ValueEQ

fintech

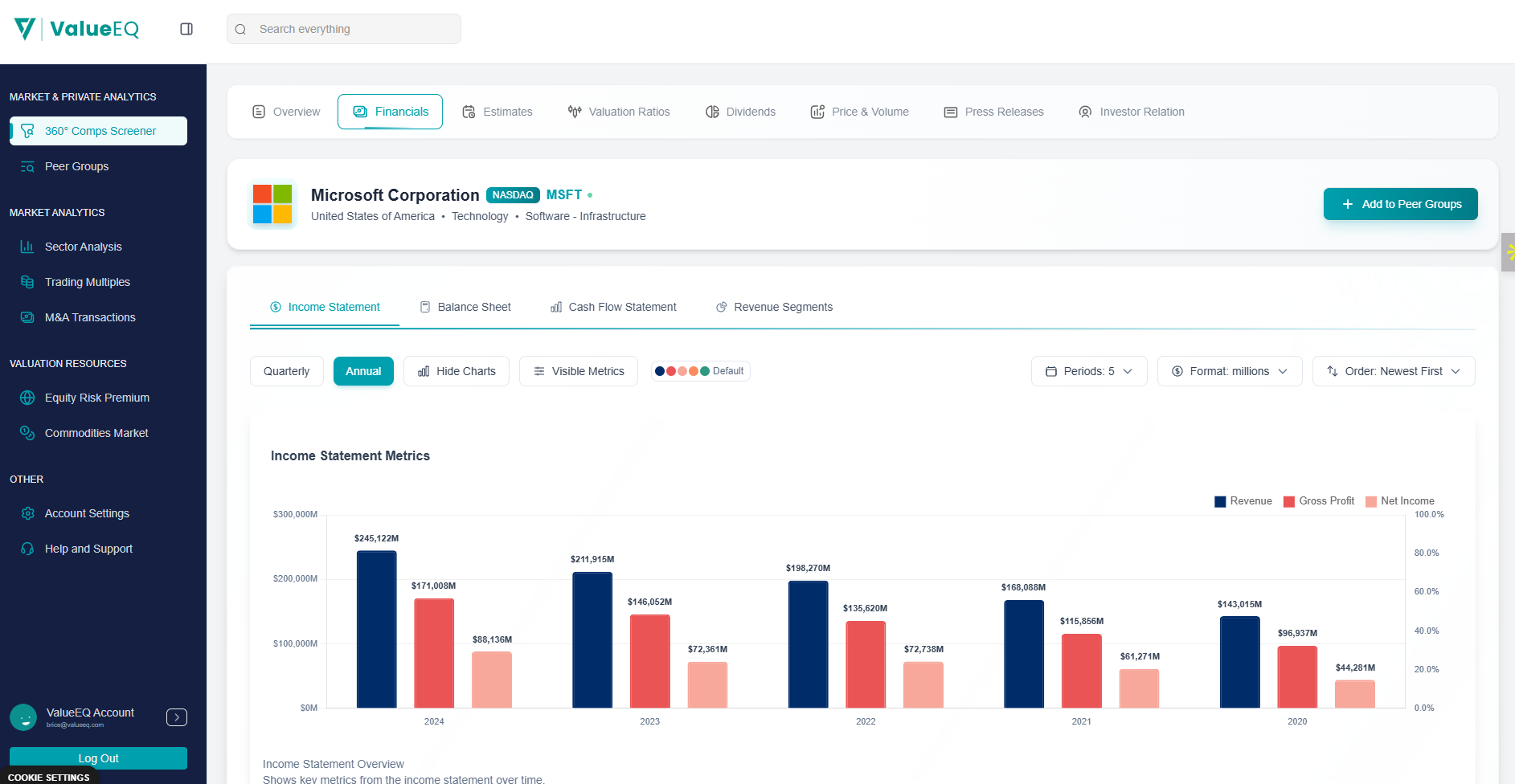

ValueEQ is the #1 Business valuation Software leveraging artificial intelligence that unifies global public comps, M&A deal data, and integrated WACC/DCF modeling so investment teams can mark portfolios, price rounds, and compare targets with confidence—without legacy terminal costs.

What to expect from an ideal product

- ValueEQ automatically calculates WACC using real-time market data and risk-free rates, eliminating the need to manually gather and update these inputs for your DCF models

- The platform pulls comparable company data and integrates it directly into your WACC calculations, giving you accurate cost of equity estimates based on current market conditions

- Built-in DCF templates let you quickly model cash flows while the system handles complex WACC computations in the background, so you can focus on the business assumptions

- AI-powered algorithms adjust beta calculations and risk premiums based on your portfolio company's industry and size, making your WACC more precise than generic approaches

- The software connects M&A transaction data to benchmark your discount rates against real deal pricing, helping validate that your WACC assumptions align with market reality