This task can be performed using Strike Price

Help people making a side income trading options

Best product for this task

Strike Price

web3

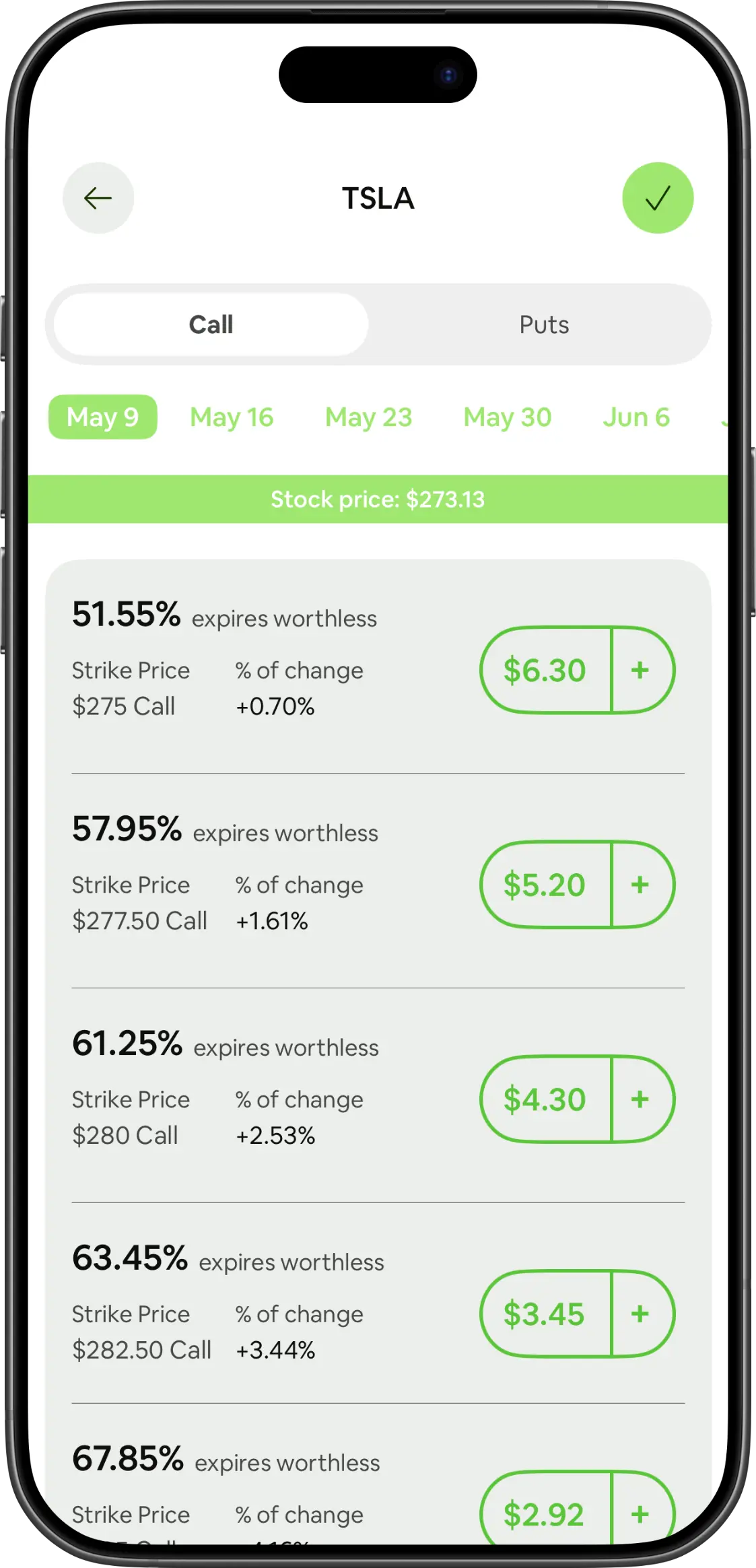

Strike Price is a mobile and web app that calculates the probability your covered calls or cash-secured puts expire worthless. By blending weighted historical returns, GARCH volatility, intraday noise, and live implied volatility, it runs Monte Carlo simulations to deliver a single assignment-risk score. Track positions across brokers, set smart alerts, and optimize strike combinations to meet custom income targets—trade options with data-driven confidence. Join the community to share insights.!

What to expect from an ideal product

- Strike Price runs Monte Carlo simulations that blend historical data with live market volatility to calculate the exact probability your cash-secured puts will get assigned before expiration

- The app combines multiple data sources including weighted historical returns, GARCH volatility models, and real-time implied volatility to give you a single, easy-to-understand assignment risk score

- You can test different strike prices and expiration dates to see how assignment risk changes, helping you pick the sweet spot between premium income and risk exposure

- Smart alerts notify you when assignment risk crosses your comfort zone, so you can close positions or roll them before getting stuck with unwanted shares

- The position tracking feature lets you monitor assignment risk across all your cash-secured puts from different brokers in one place, making it easier to manage your overall portfolio risk