This task can be performed using TrendEdge

AI-powered market insights for retail investors.

Best product for this task

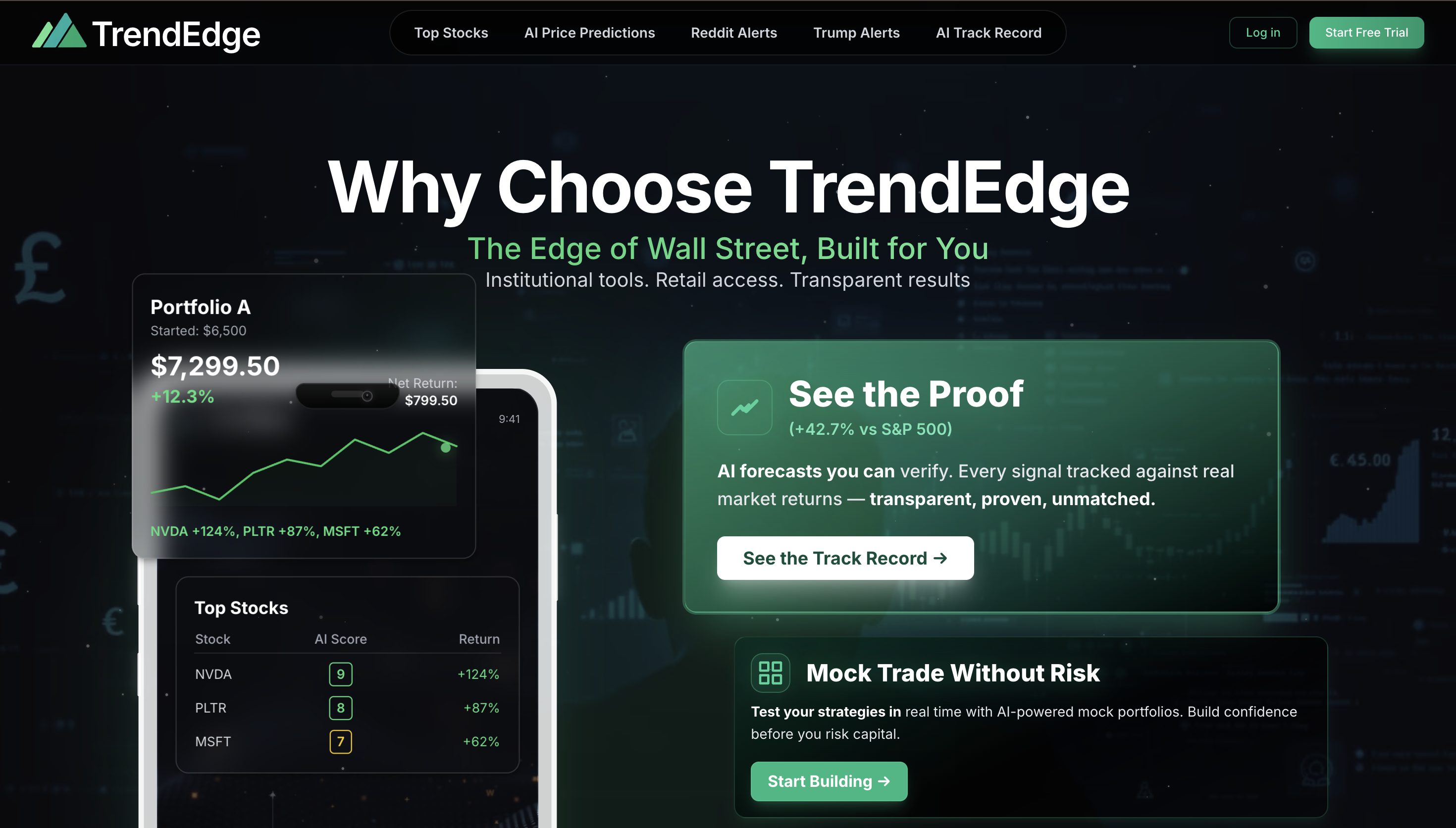

TrendEdge

analytics

TrendEdge gives everyday investors access to the same real-time market signals institutions rely on. It tracks social sentiment, alternative data, and momentum shifts using AI, helping users spot early trends before they become mainstream. Built to make market intelligence faster, clearer, and fair for everyone.

What to expect from an ideal product

- TrendEdge tracks conversations across social media platforms and news sources to measure public opinion on stocks, giving you real-time sentiment scores that show whether people are bullish or bearish on specific investments

- The platform uses machine learning to spot unusual trading patterns and momentum changes before they hit mainstream financial news, helping you get in early on emerging trends

- You get access to alternative data sources like satellite imagery, web scraping, and consumer behavior metrics that big investment firms use but were previously unavailable to individual investors

- The AI filters out noise from social media chatter and identifies which sentiment signals actually correlate with stock price movements, so you're not misled by random hype or panic

- TrendEdge combines sentiment analysis with technical indicators and market data to create actionable buy/sell signals, taking the guesswork out of timing your trades based on social trends