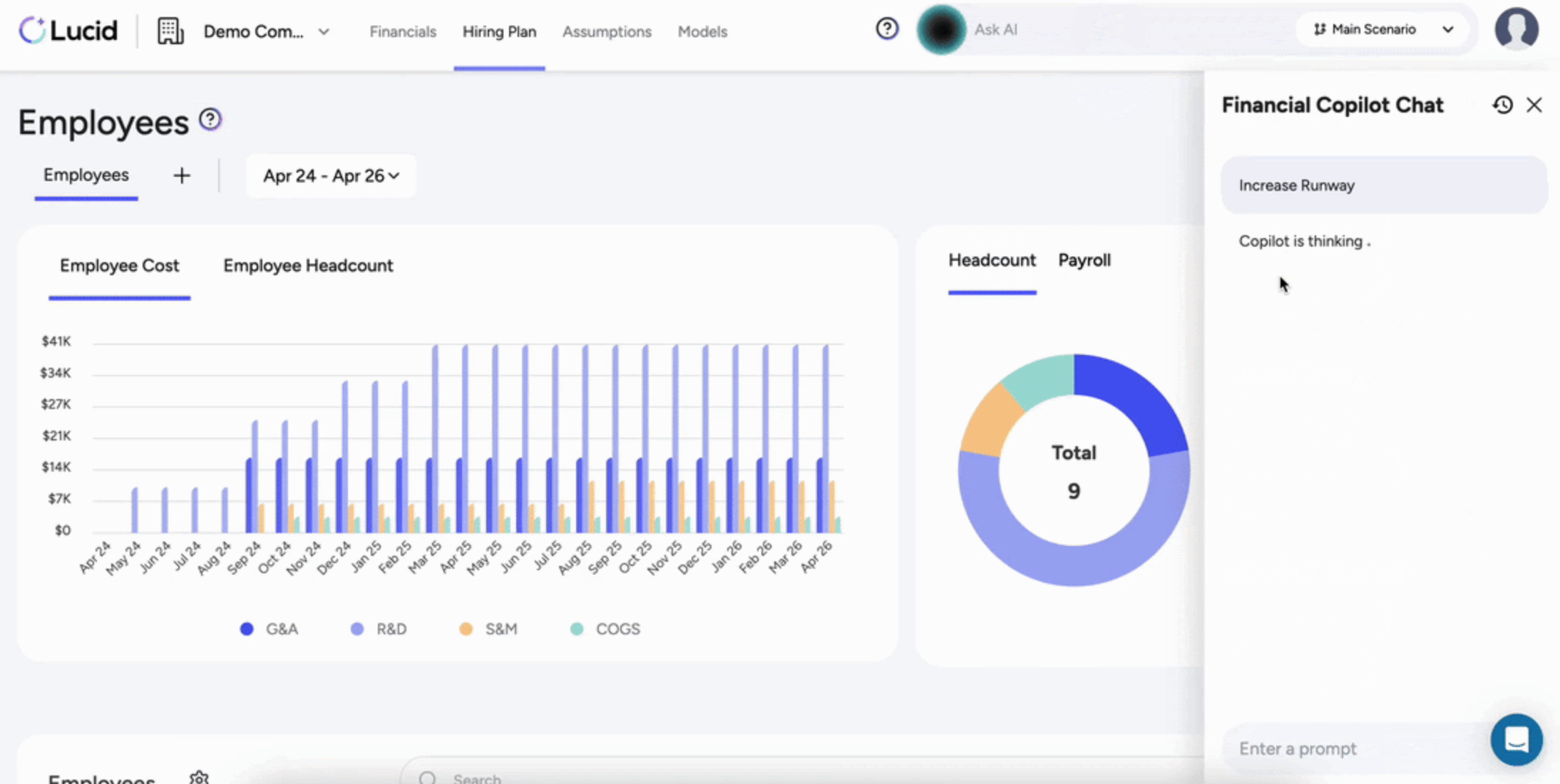

This task can be performed using Lucid

One Solution for All Your Business Finances

Best product for this task

Lucid

fintech

Bookkeeping, Taxes, Tax Credits, and CFO Services - all in one, powered by real-time AI and backed by a team of experts. Smart tech meets smarter humans. We handle the numbers. You lead the business.

What to expect from an ideal product

- Lucid's real-time AI scans your financial data continuously to spot tax deductions you might miss, like business expenses, equipment purchases, and operational costs that add up throughout the year

- The platform automatically identifies and applies for available tax credits based on your business activities, from R&D credits to small business incentives, without you having to research what qualifies

- Expert tax professionals review your books monthly to catch deduction opportunities early, rather than scrambling at year-end when it's too late to make strategic moves

- Smart categorization of expenses happens as transactions occur, so every business meal, office supply, and travel cost gets properly classified for maximum deduction potential

- The CFO services team provides year-round tax planning advice, helping you time major purchases and business decisions to optimize your tax position before filing season