This task can be performed using Venturo

Don't Let Taxes Eat Your Equity

Best product for this task

Venturo

fintech

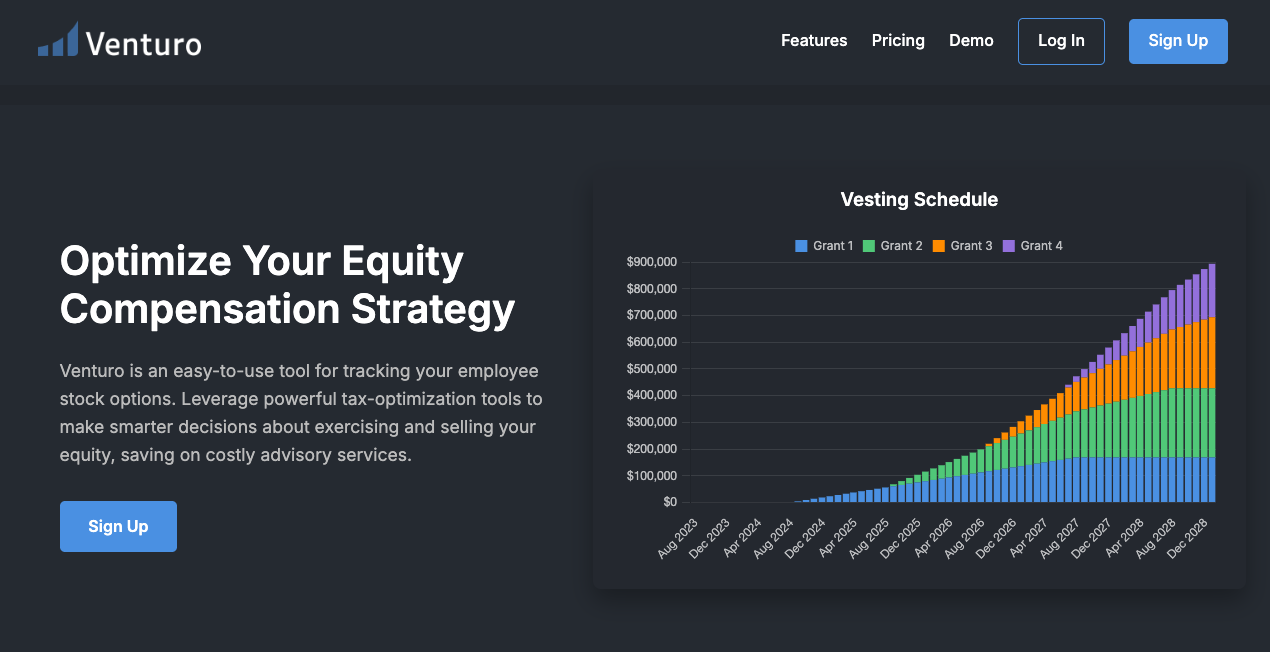

Optimize Your Equity Compensation Strategy - Track & manage employee stock options. Make tax-optimized decisions when exercising and selling your equity.

What to expect from an ideal product

- Venturo calculates the tax impact of different exercise timing scenarios so you can choose when to exercise your options for maximum savings

- The platform tracks your vesting schedule and current stock price to identify optimal exercise windows that minimize your tax burden

- You can model various exercise strategies like early exercise, cashless exercise, or hold-and-sell approaches to see which saves you the most money

- Venturo monitors AMT implications and helps you stay under thresholds that could trigger expensive alternative minimum tax penalties

- The tool provides personalized recommendations based on your income level, tax bracket, and equity timeline to maximize your after-tax gains