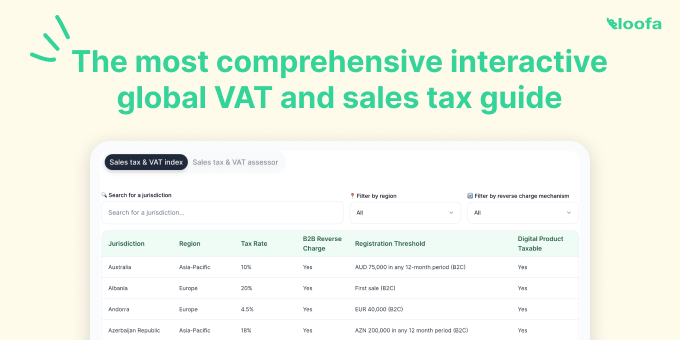

This task can be performed using Interactive global sales tax guide by loofa

Find out if you are compliant with global sales tax and VAT.

Best product for this task

Use the most comprehensive guide covering 260+ jurisdictions to see where and when you need to start charging and filing sales tax, VAT, or GST. Toggle between the index and the self-assessment app depending on if you are looking for general info or if you are looking for a tailored assessment.

What to expect from an ideal product

- Provides detailed guidance for over 260 different jurisdictions.

- Offers a self-assessment app to get personalized insights.

- Allows toggling between general information and specific assessments.

- Simplifies understanding complex sales tax, VAT, and GST regulations.

- Helps pinpoint exactly when and where to start charging and filing taxes.