This task can be performed using CPA Pilot

AI Tax Planning & Automation for CPAs & Tax Firms

Best product for this task

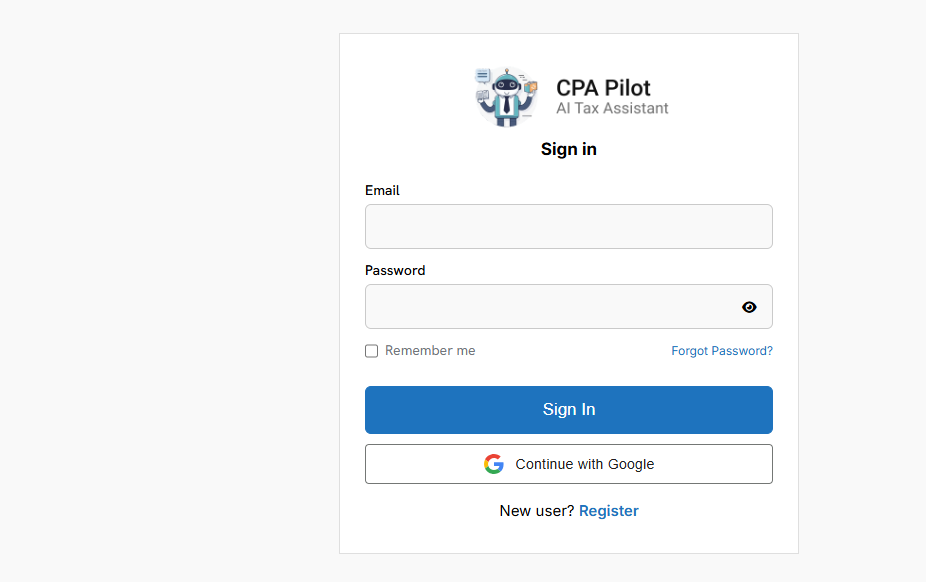

CPA Pilot

fintech

AI-powered tax planning and workflow automation for CPAs, Enrolled Agents, and U.S. tax firms.

AI-powered tax planning & strategy generationIRS & state tax code integrationWorkflow automation for CPAs & EAsClient-ready email and report generationSecurecompliantand built for professional tax firms

What to expect from an ideal product

- CPA Pilot automatically generates tax planning strategies by analyzing client data and identifying optimization opportunities without manual calculation work

- The platform streamlines client workflow management by organizing tax documents, deadlines, and planning tasks in one centralized system

- AI technology handles routine tax planning calculations and projections, freeing up CPAs to focus on high-value client advisory services

- Automated report generation creates professional tax planning documents and recommendations that can be customized for each client situation

- The system integrates with existing tax software to pull client information and push planning results, eliminating duplicate data entry across platforms