This task can be performed using Axiro

If Bloomberg and ChatGPT had a baby, it would be us.

Best product for this task

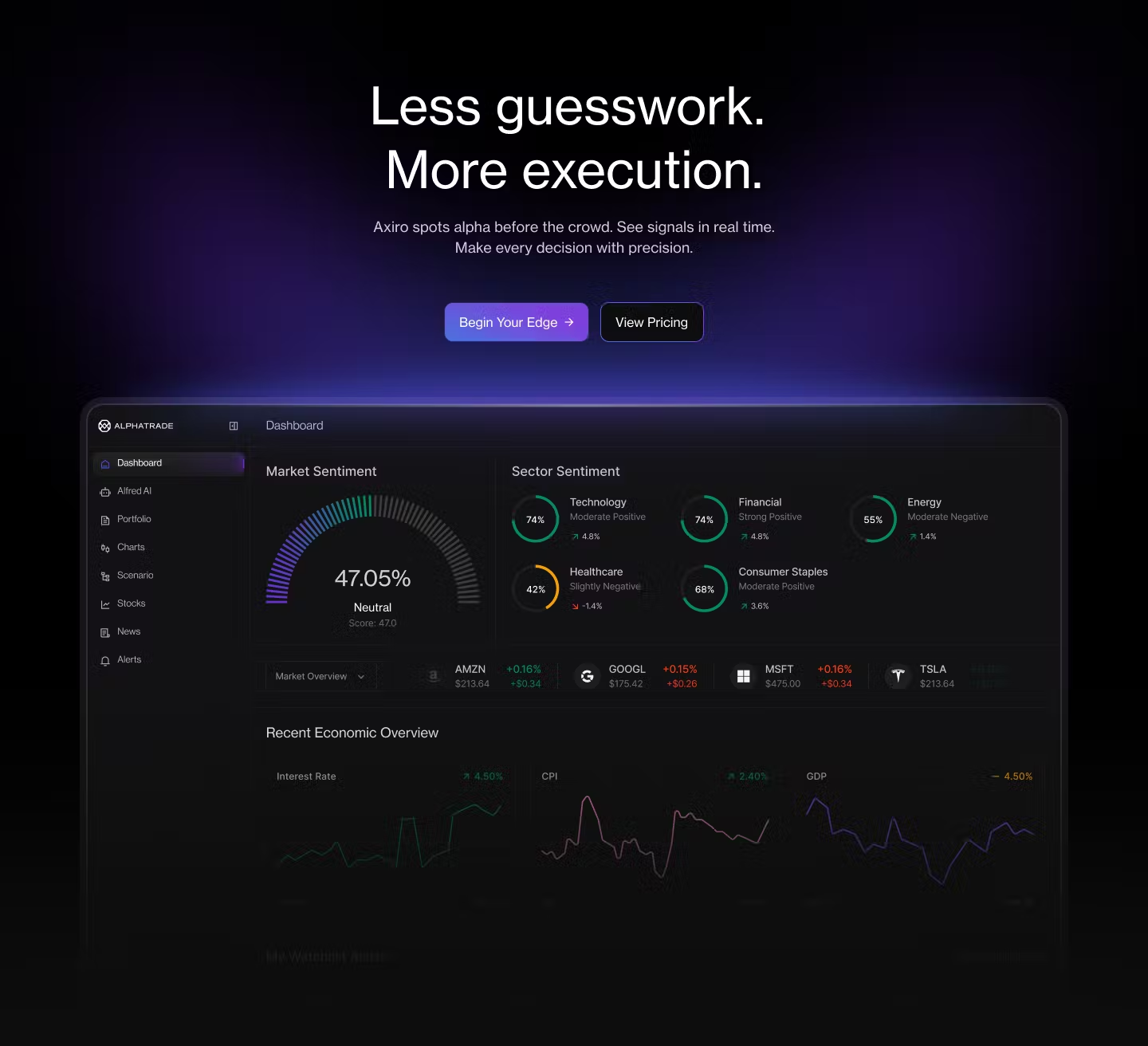

Axiro

fintech

Alpha Trade AI Journal and Axiro Research Terminal offer a powerful suite for traders, blending automated trade analytics, lifestyle insights, and AI feedback with institutional-grade tools like scenario simulators, real-time reports, and dark pool data.

What to expect from an ideal product

- Axiro Research Terminal provides direct access to institutional dark pool trading data that's typically only available to large investment firms and hedge funds

- The platform delivers real-time dark pool reports showing hidden order flow and liquidity patterns that retail traders normally can't see

- Built-in scenario simulators let you test trading strategies against actual dark pool data before risking real money in the markets

- AI-powered analytics automatically scan dark pool transactions to identify unusual activity and potential price movement signals

- The system combines dark pool insights with traditional market data to give you a complete picture of where institutional money is really moving